What is the Health Tax Credit?

In a nutshell, the health tax credit is premium assistance from the federal government offered through state-based public exchanges to help middle and lower-income families (U.S. citizens) purchase affordable coverage.

There are three ways to apply the tax credit:

1

Take it now

Pay less monthly premium (aka the advance premium tax credit)

2

Take it later

Pay full monthly premium (get a refund when filing taxes).

3

Take it partial

Split the difference monthly premium (if income/family fluctuate).

How to choose

Most people will select the advance premium tax credit option, according to Consumers Union studies.

If it’s designed to cut the cost of health insurance for Middle America, most people won’t choose to take it later and pay the full $800 per month premium. They can take the entire monthly amount as an advance credit payment and apply it to reduce the amount they pay for coverage each month. For example, they can apply the full credit toward their premium if their monthly premium is $1,000 and they qualify for $800 per month in advance credits. Each month, the federal government will pay $800 directly to their insurance company, and they will pay the remaining $200 directly to the insurer.

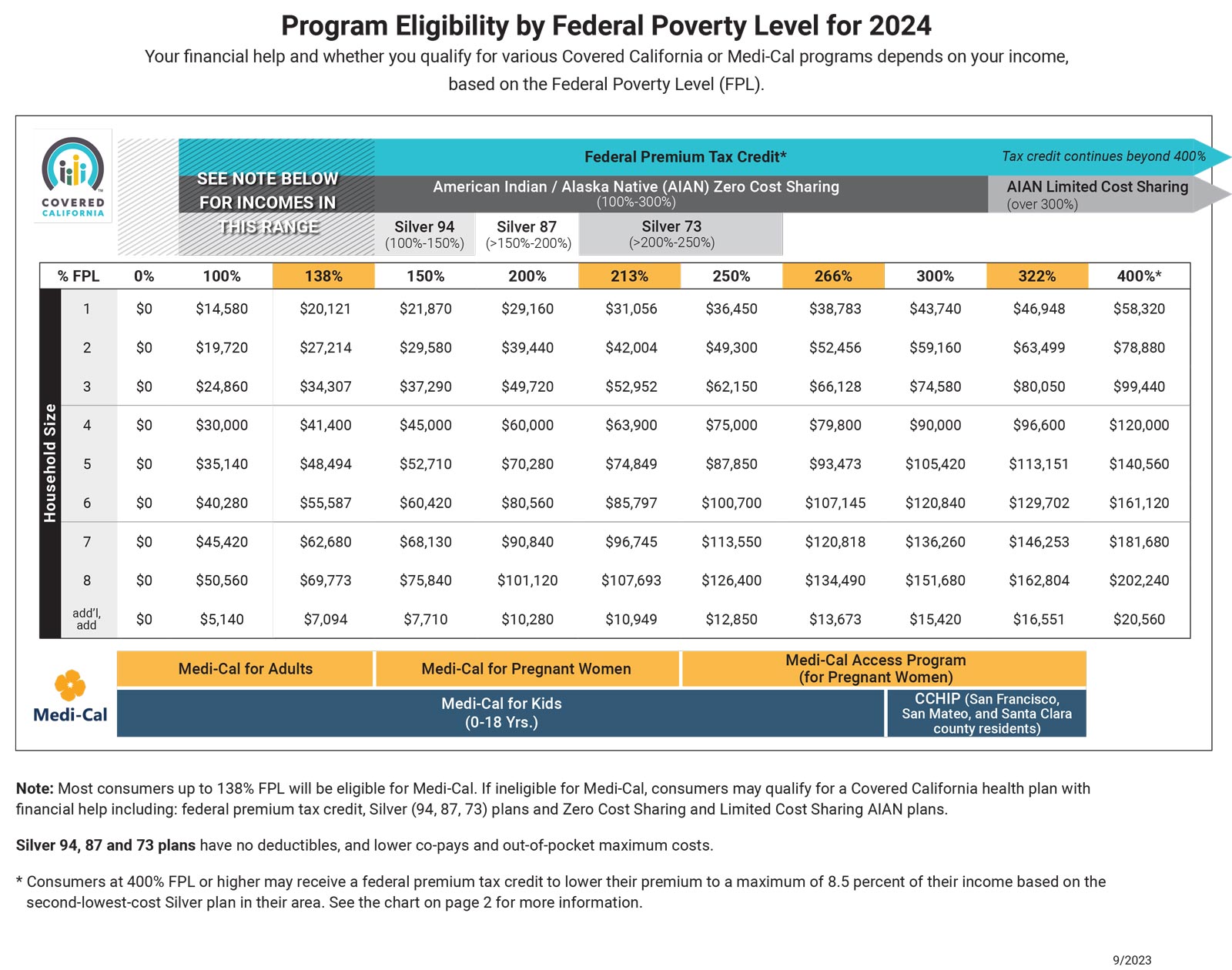

Calculating the Health Tax Credit Amount

To arrive at a net monthly cost to purchase the Silver Metal Tier Plan, It’s important to understand the advance premium tax credit calculation along with the federal poverty level (FPL) guidelines on how many are included on the household tax return and household income (i.e. Modified Adjusted Gross Income). If you are eligible for the advance premium tax credit, the net monthly cost is the most they pay for a 20-year old as well as a 55-year old. This is because the net monthly cost calculation is based on income and family size, not age. Of course, the applicant can also buy-up or down to another Metal Tier Plan. One may qualify for the advance premium tax credit if household income is less than the numbers here:

• 1 person – $54,360

• 2 person – $73,240

• 3 person – $92,120

• 4 person – $111,000

• 5 person – $129,880

• 6 person – $148,760

Furthermore, any income and family size changes that occur current-year that lead to under-projecting or over-projecting this year’s household income will affect the advance premium tax credit calculation. How many people know their household income a year in advance? Nobody. The bottom line is that they have to project their income using old data and attempt to take future changes into account. And, if changes do occur mid-year, they can always call Covered California and communicate the change, which would re-calculate the advance premium tax credit. Or they can wait until filing current-year taxes and see where they stand with a refund if their income went down and/or family size went up or a repayment if their income went up and/or family size went down.

You should not be overly concerned if you project the repayment incorrectly. This may be a good time to highlight the triple-subsidy approach laid out by the federal government:

- The advance premium tax credit will subsidize the premium cost.

- Eligible applicants in a specific FPL range will have subsidized out-of-pocket costs (See Silver one to four eligibility categories).

- Any excess advance premium tax credit amount has a repayment cap based on the applicants FPL. For example, an individual making $25,520 (under 200% FPL) would have a $300 repayment cap.

Employee Benefits

Under the Fair Labor Standards Act 18B, employers are required to provide a notice to employees, by October 1st, describing the coverage options available on the exchange. Your employers must tell all employees about the exchange and the new health tax credit. There may not be much impact for employers who already offer a health plan to their employees unless the health plan is considered unaffordable (more than 9.83% of the employee’s W2 income) or doesn’t meet minimum essential coverage with an actuarial value of 60% (the plan pays for 60% of the out-of-pocket costs).

If your employer meets affordability and minimum essential coverage testing neither the employees nor their spouse and children will be eligible for the tax credit. This may be problematic in a few scenarios. Today, most employer-sponsored plans cover little or none of the dependent premium, which means that many of these dependents are not currently covered.

The IRS and Covered California have described an option that hasn’t been utilized in structuring employee benefit portfolios: Employers can provide a group plan that only offers coverage to employees. This is a workaround for dependents to be eligible for the advance premium tax credit in the individual exchange. It may not be the best solution, but it is an option for brokers and employers to wrestle with.

Another workaround option is to raise the employee cost to be greater than 9.83% of their W2 income. This would allow all employees and dependents to apply for the advance premium tax credit. This option is a little easier to swallow for groups under 50 lives, but it comes with eventual penalties for large groups in 2015.

At the end of the day, the ACA is multi-faceted with many angles. It was designed to help Americans purchase affordable coverage, though it may take us to a single-payer system. The reality is most employer groups subsidize a large portion of the health insurance premium for full-time employees. Part-time employees may still be eligible for the advance premium tax credit.

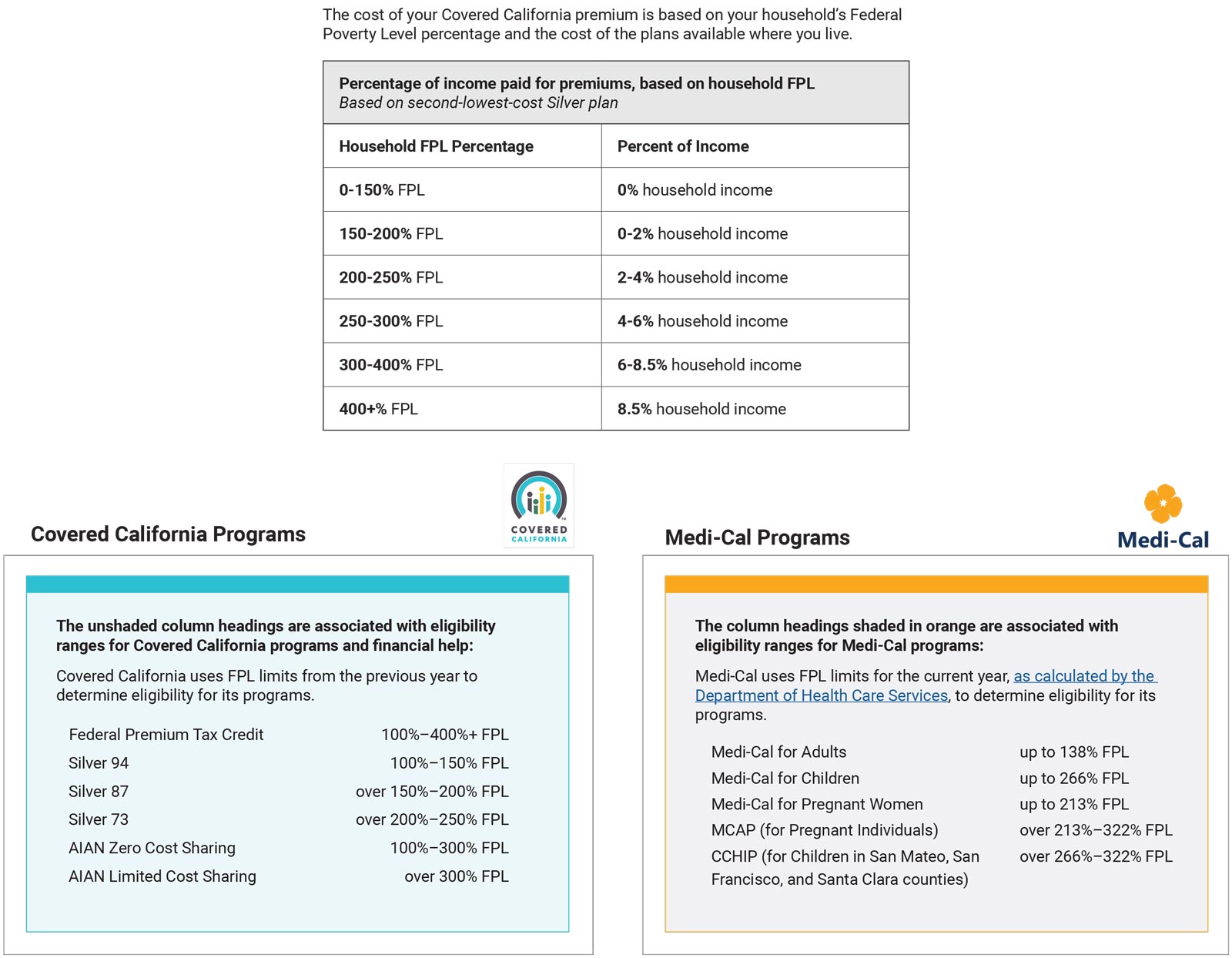

Your small business may be eligible to receive a federal tax credit to offset the cost of providing health insurance

To learn more, download this free PDF from Covered California Small Business:

The Advance Premium Tax Credit has seven eligibility categories

If you are an employer with a large employee base, how do you know who should be taking advantage of the State and Federal programs which they are entitled? Does every one of your employees belong in your group health insurance program?

1. Already Covered

Not eligible for the advance premium tax credit if covered under a group plan, eligible for group coverage through a spouse, or over age 65 on Medicare. This is the first category that contains most all our employer client blocks of business, except for part-time employees who aren’t eligible for coverage on the employer plan.

2. Medi-Cal (0% to 138% FPL

Not eligible for the advance premium tax credit. This can be a problem if an employer cancels their group plan and lower income Medi-Cal eligible employees don’t qualify for the advance premium tax credit.

3. Silver 1 (138% to 150% FPL)

This is the least expensive monthly cost plan for applicants with the advance premium tax credit, and the richest plan benefit with subsidized out-of-pocket costs (i.e. $0 deductible). In other words, it’s actually the most expensive plan offered with the highest advance premium tax credit applied to cover most of the premium.

4. Silver 2 (150% to 200% FPL)

This is the next jump up in monthly cost and subsidized out-of-pocket with advance premium tax credit. This category plan has a $500 deductible.

5. Silver 3 (200% to 250% FPL)

This plan category has a $1,500 deductible plan benefit with a smaller amount subsidizing the out-of-pocket costs.

6. Silver 4 (250% to 400% FPL)

This category includes a $2,000 deductible. Applicants in this category would be wise to look at applying the advance premium tax credit to a buy-down Bronze plan option, or even the Catastrophic Plan if under 30 years old.

7. No Subsidy (+400% FPL)

This category of applicants should be encouraged to shop for a health plan both inside and outside the exchange. Since there is no advance premium tax credit available, it may not be advantageous to purchase a plan in the exchange.